It’s 2020, and everything seems to be experiencing a revolution. Articles use popularized clichés like “the new normal” and “unprecedented times” either as clickbait, filler, or social satire (my preference). I won’t apply these clickbait headlines to describe the more long-term market shifts within clinical care, although disruptors within the ambulatory market have completely shifted how health systems need to approach their clinical network.

Competition within the ambulatory environment, from telehealth offerings like 98point6 to CVS HealthHub, ChenMed, and Walmart, has changed the ways patients receive ambulatory care, so much so that insurers are buying into their value propositions and are actively steering patients there, allowing disruptors to influence downstream acute care referrals. Traditional health systems have two options: compete or capitulate.

This isn’t a 2020 revolution. It’s been a long time coming, and health systems must adapt to these shifts in the market to remain competitive. Market disruptors are ahead of the game and going for scale through a variety of approaches, leveraging technology and strategically placed bricks and mortar to capture large patient panels of younger, healthier patients. Others are pursuing specialization, managing smaller patient panels with chronic conditions, and proving their value to payers through a comprehensive hands-on approach.

Health systems choosing to compete must leverage their scale, arsenal of multispecialty physicians, and comprehensive continuum of care to improve the patient experience and stymie competition. For most health systems, the traditional standalone physician clinic is not the answer for scale: CVS and Walgreens have demonstrated that. Consolidation of physician clinics into multispecialty practices that over-deliver on patient experience is.

Competing through Consolidation

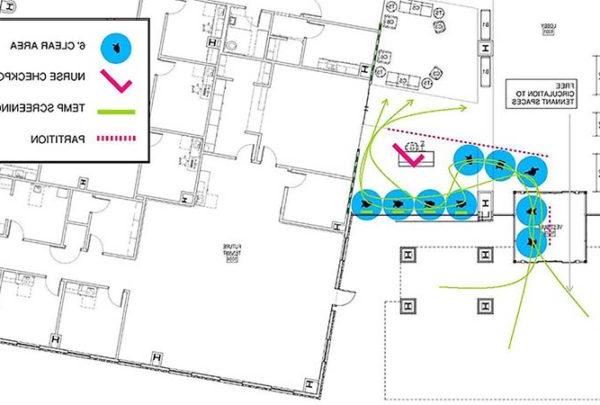

Achieve economies of scale with your capital: Continued reimbursement pressures are forcing health systems to look at their capital and cost structure, pursuing economies of scale while reducing their facility overhead. The argument for clinic consolidation begins with achieving higher patient volumes while gaining efficiency improvements and eliminating redundancies. Through consolidation, health systems can reduce their capital overhead related to facilities and equipment while driving higher utilization of revenue-producing assets. Due to these gained efficiencies, consolidated clinics deliver higher margins and revenue per square foot, ultimately proving a business case for sustained capital investment.

Leverage support staff and reduce redundancy: Like physical capital, support staff is made more efficient and streamlined through consolidation. Previously underutilized support staff can be leveraged across numerous practices due to shared operational processes and common space, such as patient registration. Meanwhile, staff made redundant can be reallocated across the system to areas previously strained for help.

Geographic pull: By leveraging economies of scale through the variety of practices involved, systems can place a higher dollar investment in the facility and overall patient experience. Larger MOBs and multi-practice sites have a broader geographic pull due to their variety of specialty offerings, improved care coordination, and higher quality facilities compared to traditional standalone clinics.

Leveraging technology for patient care and clinic operations: The scale of consolidated clinics improves the business case for system investment in technology. While standalone clinics struggle to receive the investment necessary to pursue innovative technologies, consolidated clinics and multispecialty practices have the scale to properly utilize new technologies, creating a more appealing business case for financing. Operational technologies improve administrative processes and the patient and provider experience, while reducing the need for common and support space, creating a larger footprint for revenue-producing assets. More importantly, clinical technology improves the quality and coordination of care, reduces clerical errors, improves provider efficiency, and ultimately supports superior clinical outcomes.

Addressing Shortfalls

Geographic distribution: The primary strategy behind standalone physician clinics is the opportunity to spread across a broad geography. A general rule of thumb was that a patient should be able to access primary care in the same amount of time it takes to get to the grocery store. With consolidated clinics, some markets may lose this geographic advantage, the ultimate strategy being that patients will be drawn to the consolidated clinic’s halo effect and multispecialty service offering.

Lost advantages in geography can be mitigated with investment in telehealth implementation, connecting to patients regardless of geography and many times in a more convenient setting – their home. With recent changes in reimbursement policy, telehealth solutions are rapidly becoming implementable.

The key to successful consolidation is to evaluate and mitigate these risks. For outlying areas still considered target markets, outposts can be established through small retail sites to maintain community relationships, connecting patients to sites with higher acuity service offerings either through referrals or on-site clinically guided telehealth visits.

Physician buy-in: Practices eligible for consolidation will face physician pushback, and understandably so. Many physicians have devoted their careers to developing their practice, establishing relationships with their patient panels and the broader community. Clinic consolidation threatens those long-time relationships (and their bottom-line). To gain physician buy-in health systems must create a space that improves the patient and physician experience while not affecting the physician’s bottom-line. Overlooking these concerns will anger physicians, drive attrition, and broaden the provider supply gap that many systems are facing.

Patient attrition: With any provider change comes the risk of losing patients. This risk is certainly applicable to clinic consolidation where patients leave due to changes in distance, interest in retail competition, or a host of other factors. Mitigating these risks with early and clear communication about the benefits of the new model, seamless operational transition, and an improved patient experience is key. Ultimately the goal is to mitigate losses with a strategic location and superior product that will retain existing patients, backfill losses, and provide a strategic site for growth.